All Categories

Featured

Table of Contents

The are entire life insurance policy and universal life insurance. The cash value is not added to the death advantage.

The plan lending interest price is 6%. Going this route, the rate of interest he pays goes back right into his plan's money value instead of a monetary establishment.

Infinite Concept

Nash was a money specialist and fan of the Austrian college of business economics, which supports that the value of goods aren't explicitly the outcome of conventional economic structures like supply and demand. Instead, people value money and items in different ways based on their financial standing and requirements.

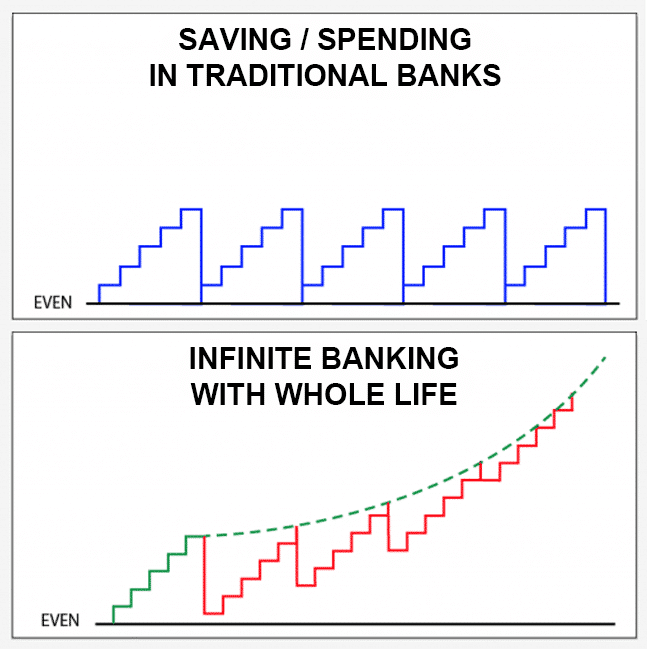

One of the pitfalls of standard banking, according to Nash, was high-interest prices on financings. Long as financial institutions set the rate of interest prices and finance terms, individuals didn't have control over their own riches.

Infinite Banking requires you to own your economic future. For ambitious people, it can be the ideal financial device ever before. Below are the advantages of Infinite Banking: Arguably the single most helpful aspect of Infinite Financial is that it boosts your money flow.

Dividend-paying entire life insurance is really low danger and supplies you, the policyholder, a great deal of control. The control that Infinite Financial provides can best be organized into 2 classifications: tax obligation benefits and asset defenses.

Bank Concept

When you utilize whole life insurance for Infinite Financial, you enter into a private agreement in between you and your insurance coverage business. These defenses may vary from state to state, they can consist of protection from property searches and seizures, security from reasonings and protection from financial institutions.

Entire life insurance coverage policies are non-correlated possessions. This is why they work so well as the financial structure of Infinite Banking. No matter of what takes place in the market (supply, genuine estate, or otherwise), your insurance policy maintains its worth.

Whole life insurance policy is that 3rd pail. Not just is the rate of return on your whole life insurance plan ensured, your fatality benefit and premiums are additionally guaranteed.

Right here are its major advantages: Liquidity and availability: Policy lendings offer instant accessibility to funds without the limitations of conventional bank loans. Tax performance: The money worth expands tax-deferred, and policy car loans are tax-free, making it a tax-efficient tool for building wide range.

Royal Bank Infinite Avion Redemption

Possession defense: In numerous states, the money worth of life insurance policy is safeguarded from financial institutions, including an added layer of financial safety and security. While Infinite Financial has its merits, it isn't a one-size-fits-all service, and it includes significant downsides. Below's why it might not be the best method: Infinite Banking often needs elaborate plan structuring, which can perplex insurance policy holders.

Picture never ever having to worry about financial institution financings or high rate of interest rates again. That's the power of boundless financial life insurance policy.

There's no collection car loan term, and you have the freedom to choose the settlement timetable, which can be as leisurely as repaying the loan at the time of fatality. This adaptability reaches the maintenance of the finances, where you can choose interest-only repayments, maintaining the car loan equilibrium level and manageable.

Holding money in an IUL repaired account being credited interest can typically be much better than holding the money on down payment at a bank.: You have actually constantly imagined opening your very own bakeshop. You can borrow from your IUL plan to cover the initial costs of renting out an area, buying devices, and hiring team.

Whole Life Insurance Bank On Yourself

Individual loans can be acquired from conventional banks and credit history unions. Obtaining money on a debt card is typically really expensive with yearly portion rates of interest (APR) typically getting to 20% to 30% or more a year.

The tax treatment of plan finances can vary dramatically depending on your country of house and the details regards to your IUL policy. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy fundings are typically tax-free, offering a significant advantage. In other territories, there might be tax obligation effects to take into consideration, such as potential tax obligations on the car loan.

Term life insurance only offers a death benefit, without any kind of money value build-up. This implies there's no money worth to borrow versus.

Nevertheless, for lending police officers, the substantial policies imposed by the CFPB can be viewed as cumbersome and limiting. Car loan officers typically argue that the CFPB's policies create unnecessary red tape, leading to more documents and slower loan processing. Policies like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) needs, while focused on shielding consumers, can result in hold-ups in closing deals and enhanced operational prices.

Latest Posts

Infinite Banking With Whole Life Insurance

Cash Flow Whole Life Insurance

Whole Life Concept